This sets up what's known as a lemons problem in economics. So which is it? Are unrated issuers small but high quality municipalities, or are they larger, riskier ones? The answer most researchers have come to is that unrated issuers are probably a combination of the two groups. These risky muni issuers may decide it is easier to simply skip the rating altogether and issue unrated bonds instead. So it makes sense that a small city or a school district might not want to pay to have their bonds rated - it could simply be too expensive, even though the city or school will end up paying a little more in interest.īut it's also possible that unrated bond issuers are mainly risky issuers who don't want to pay the rating agencies to rate their bonds, because they know they will end up with low ratings and high bond yields anyway. Well, maybe… after all, getting a bond rated by the rating agencies is expensive… frequently about $500,000. So if large, rated muni bonds are safe, are unrated small municipal issuers also safe? Can an investor earn extra returns without taking on too much extra risk by holding unrated bonds from small municipalities? (I will also go over variable rate muni bonds in a future article.) But what these statistics do suggest is that credit risk is very, very low in muni bonds. (I will go over this more in a future article.) Nor does mean that a muni bond holder couldn't lose money even if their bond didn't default - interest rate risk is still a very real problem for those holding long maturity fixed rate bonds. In fact, even when municipal bonds do default, recovery rates are very high. Now of course, this also does not mean that if a person held a bond that defaulted, then they would lose all of their money in the bond. This is for all municipal bonds, investment grade and non-investment grade, and we are talking about the default rate over the entire life of the bond, not in any particular year.

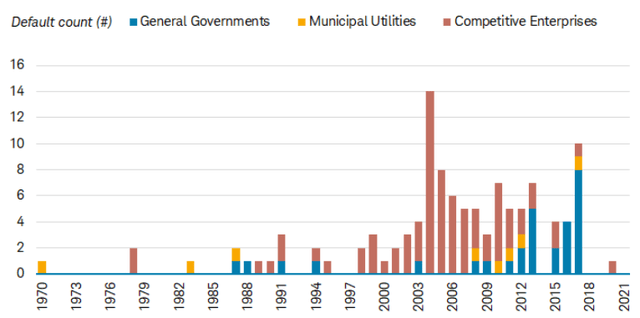

This means that, on average, rated municipal bonds defaulted at a rate of about 0.64%, or roughly 1 bond out of every 150 issued. During that period, roughly 11,000 municipal bonds were issued. As most of you reading this probably know, the higher the rating, the less the bond yields, all other things (like maturity) the same.īetween 19, there were 71 defaults on rated municipal bonds, 46 of these occurred after 1986. These bonds are usually for larger issuers, and they pay lower yields than unrated bonds.

Let's start by talking about rated municipal bonds - that is, muni bonds that are rated by one of the three major rating agencies: S&P, Moody's, and Fitch. So with that in mind, I wanted to put some numbers out there regarding municipal bonds, and help to quantify the risks for these securities.īear in mind all of the figures I report here in this article come from one of four sources: Standard & Poors, Moody's, the NY Fed, and the MSRB (Municipal Securities Ruling Board).

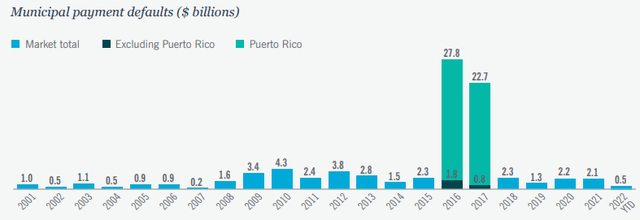

With all of the high profile municipal bond defaults and scares in the last few years from Vallejo, CA to Harrisburg, PA, it is easy to get spooked about the normally staid and safe muni bond market.

0 kommentar(er)

0 kommentar(er)